1 IN 4 MILLENNIALS AND GEN-ZS ARE USING CHALLENGER BANKS WITH MONZO THE MOST POPULAR

A survey of UK consumers by digital banking solutions provider CREALOGIX has uncovered trends in the adoption of mobile-first challenger banks.

There's a basic revolution happening in banking. A survey of 2,000 UK consumers commissioned by CREALOGIX finds 1 in 4 under 37s have confirmed they are using digital-only challenger banks and 14 per cent of UK bank customers across all age ranges have at least one mobile-only digital banking provider. Up to and including third of under 37s have two or more accounts with challenger banks.

While the major banks maintain their dominant share of the market of current accounts at 87%[1], the digital-only banks are gaining ground amid high amounts of activity in new account opening. 44% of survey respondents have opened a minumum of one new bank account in the last Five years, increasing to almost 80% of Gen-Zs.

61% of UK banking account customers are thinking about opening a merchant account with a new provider in the next 3 years. This trend increases with Millennials and Gen Zs, with 75% looking to open a new account in the next three years. Take up of the digital-only challenger banks is 3 times higher amongst these age ranges, demonstrating the extent that the preferences of the digitally-savvy younger generations are driving the disruption of the market.

The research also suggests newcomers are obtaining market share at a rapid pace. German challenger bank N26 feature within the survey results even though they only just launched in the UK in October 2021. 3% of Gen-Zs and 2.5% of Millennials surveyed said they've an N26 account, which would include individuals who signed up for early access or are still on a waiting list.

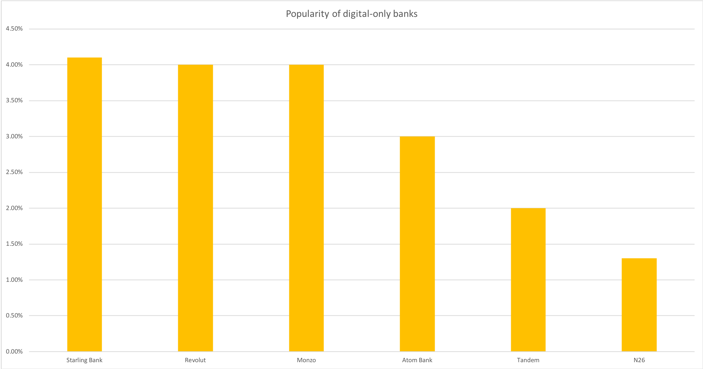

The survey of two,000 consumers by CREALOGIX also revealed typically the most popular mobile-only digital challenger banks: Starling, Revolut and Monzo – Monzo being the most popular for the under 37s. (While Starling Bank and Monzo are licenced banks in the united kingdom, Revolut currently operates via an e-money licence in the united kingdom and uses passporting to distribute its offering across other Eu markets.)

Preferences changed markedly for older respondents, which overallare a smaller amount likely to use a challenger bank – only 6% of over-55s said they had an account with one of the leading challenger brands. People who do have accounts with challengers preferred to use Revolut and Atom Bank.

After the financial crisis of 2008, market share from the major high street banks concentrated, with over 80% (and at times as much as 90%) of private current accounts (PCAs) held in only the biggest six firms[2]. Soon after this a YouGov survey (2021) on public rely upon banking found that consumer satisfaction what food was in an all-time low.

The new CREALOGIX research asked UK challenger bank customerswhat they liked best regarding their bank. Customers repeatedly highlighted ease of use, customer experience, accessibility, flexibility and innovative functionality such as the ability to lock bank cards temporarily, and obtain mobile notifications and visual summaries about spending activity.

When asked the things they liked about using a digital challenger bank, one interviewee said: “This has become the easiest account I have opened. It is the only account I have where you can nominate the date your interest is paid and that predicts the amount of interest due for entire term of deposit”.

Another interviewee said: “I love how easy it's to use, how I can freeze my card modify my settings on the fly and use the card freely abroad. I really like my Monzo and Starling accounts because they are easy to use and easily accessible. They assist me to budget my money and get saving goals.”

Jo Howes, Commercial Director at CREALOGIX UK, said: “The big question of fintech in the UK has been whether the new banks could eat into the highly centralised market share of the top tier banks. We are now seeing figures that clearly show the challenger banks are earning rapid progress and gaining share of the market. The figures and rate of change are enough now to make incumbents sit up and take serious notice. Our research shows that consumers are attracted to the convenience, usability, and personalisation available from the challengers. To respond to the challenge, established banks need to accelerate their digital transformation and prioritise customer-oriented benefits and features.”

Anton Zdziebczok, Head of Product Strategy at CREALOGIXUK, said: “When they announced a restricted beta launch recently, N26 had over 50,000 new UK customers on the waiting list. We are used to seeing lines around the block for new iPhone releases, but this is surprising for a bank account. For the first time, people are actually excited about what's on offer from a bank. This is no accident because the challengers are utilizing consumer-oriented design and marketing ways of reimagine what banking can look and seem like. The question for incumbents – including both bank and building societies – is how they can transform their own offerings into something with enough appeal to compete with this influx of innovative competitors.”

The independent study was undertaken by Censuswide between 7-12 November 2021. It interviewed 2,000 18-65 year olds who currently have a bank account.

Media and industry specialists who would like to find out more about digital banking solutions from CREALOGIX can book a consultation via their website at: https://crealogix.com/uk/products/crealogix-digital-banking-hub/