Mortgage credit rating, and the approaching buy storm

Mortgage credit score remains the tightest it's been in additional than six years, however an unwavering February often is the calm earlier than the acquisition storm as lenders come up with for a revitalized economic system, the Mortgage Bankers Affiliation produced in a report on Tuesday.

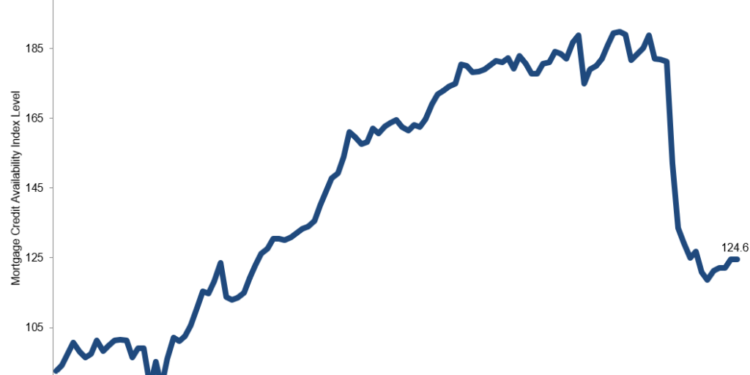

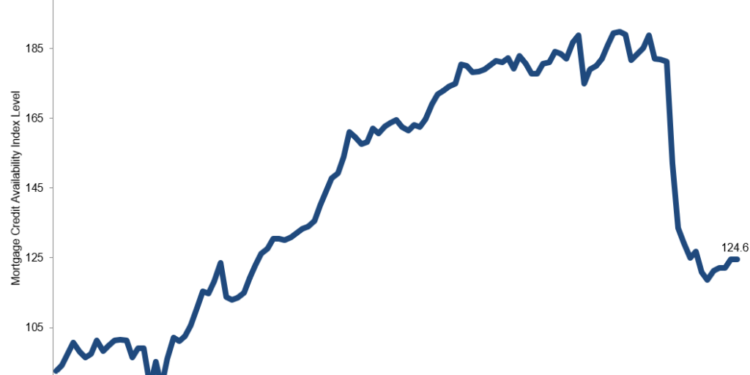

The group's Mortgage Credit score Availability Index remained unchanged at 124.6 final month, nonetheless hovering near to ranges beforehand observed in 2021. The index plunged from document highs seen in late 2021 after the COVID-19 pandemic resulted in the worst financial contraction for the reason that Nice Melancholy.

Measuring credit score availability by mortgage kind, the Conforming MCAI that tracks loans backed by Fannie Mae and Freddie Mac fell .7% whereas the Jumbo MCAI measuring high-balance loans rose .2%, and also the Standard MCAI that measures loans not backed by the federal government fell .3%.

The Authorities MCAI that has mortgages backed by the Federal Housing Administration, the Veterans Administration and the U.S. Division of Agriculture rose .3%, MBA stated.

A decline inside the MCAI ensures that lending requirements are tightening, whereas will increase within the index are indicative of loosening credit score.

In reaction to Joel Kan, MBA's affiliate vice chairman of monetary and trade forecasting, regardless of a just about unaltered February, the housing industry is within sturdy form heading into the spring, with strong progress in buy functions, residence product sales and new residential development.

“Anticipated residence product sales progress this 12 months remains to be prone to be pushed by first-time patrons, spurred by millennials reaching peak first-time homebuyer age,” Kan stated. “A lot of those potential patrons will seemingly take full advantage of FHA and different information cost loans to purchase a house.”

Nevertheless, authorities credit rating provide has elevated in 5 from the previous 6 months, albeit in small increments, however stays tight by historic requirements. This provides another impediment for a lot of aspiring first-time patrons who’re already navigating provide and affordability constraints, Kan famous.

However the MBA is anticipating huge issues from first-time homebuyers in 2021. The commerce group’s chief economist, Mike Fratantoni, stated the rebounding economic climate and rising purchaser demand dovetails with most millennials approaching peak first-time homebuyer age.

“The most important cohort of millennials are actually 29, and traditionally, peak first-time homebuyer age is 32 or 33. The MBA is forecasting this wave of younger homebuyers will help the acquisition marketplace for at the very least the next couple of years,” Fratantoni stated.

The Nationwide Affiliation of Residence Builders' fourth quarter 2021 survey of potential homebuyers additionally confirmed that 27% of millennial respondents deliberate to purchase a home within the subsequent 12 months, up from 19% within the prior 12 months's survey.

The publish Mortgage credit rating, and also the approaching buy storm appeared first on HousingWire.